A) low correlations between investment grade bonds and high yield bonds.

B) high correlations between investment grade bonds and high yield bonds.

C) low correlations between various investment grade bond indexes.

D) negative correlations between investment grade bonds and high yield bonds.

E) None of these are correct.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The Dow Jones Industrial Average is a value weighted average.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The New York Stock Exchange Index is based on a sample of all of the New York Stock Exchange stocks.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a value-weighted series?

A) NASDAQ Industrial Index

B) Dow Jones Industrial Average

C) Wilshire 5000 Equity Index

D) American Stock Exchange Series

E) NASDAQ Composite Index

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a global equity indicator series?

A) Morgan Stanley Capital International Indexes

B) Dow Jones World Stock Index

C) FT/S & P-Actuaries World Indexes

D) Merrill Lynch-Wilshire World Indexes

E) Brinson Partner Global Security Market Index (GSMI)

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a value weighted index,

A) exchange rate fluctuations have a large impact.

B) exchange rate fluctuations have a small impact.

C) large companies have a disproportionate influence on the index.

D) small companies have an exaggerated effect on the index.

E) None of these are correct.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The Dow Jones Industrial Average has been criticized for being blue-chip biased.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A style index created to track ethical funds is known as the

A) green index.

B) SRI index.

C) EAFE index.

D) freedom index.

E) ethical index.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

It is easier to construct an indicator series for bonds because of their relatively stable returns pattern.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

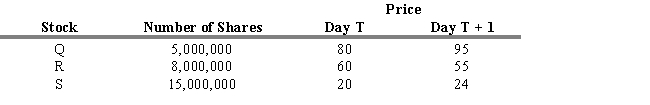

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 4.6. Calculate a price weighted average for Day T.

-Refer to Exhibit 4.6. Calculate a price weighted average for Day T.

A) 46.20

B) 53.33

C) 54.12

D) 92.39

E) 108.23

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

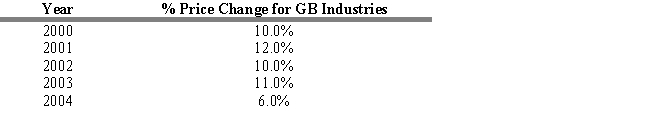

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 4.3. Calculate the average annual rate of change for GB Industries for the five-year period using the geometric mean.

-Refer to Exhibit 4.3. Calculate the average annual rate of change for GB Industries for the five-year period using the geometric mean.

A) 9.7800%

B) 0.0978%

C) 9.0700%

D) 0.0970%

E) 3.6400%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

-Refer to Exhibit 4.2. Calculate a value weighted index for January 16th if the initial index value is 100.

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

-Refer to Exhibit 4.2. Calculate a value weighted index for January 16th if the initial index value is 100.

A) 123.07

B) 100.00

C) 102.31

D) 111.54

E) 121.32

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

For an indexed portfolio, the fund manager will typically attempt to replicate the composition of the particular index exactly.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a price weighted average stock market indicator series, the following type of stock has the greatest influence:

A) the stock with the highest price.

B) the stock with the lowest price.

C) the stock with the highest market capitalization.

D) the stock with the lowest market capitalization.

E) the stock with the highest P/E ratio.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A benchmark measures the performance by portfolio managers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

-Refer to Exhibit 4.5. Calculate the value weighted index for Dec 31, 2003, after the splits. Assume a base index value of 100. The base year is Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

-Refer to Exhibit 4.5. Calculate the value weighted index for Dec 31, 2003, after the splits. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 72.5

B) 81.69

C) 100.0

D) 120.0

E) 121.25

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The most common way to test a portfolio manager's performance is to compare the portfolio return to a benchmark.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

-Refer to Exhibit 4.2. Calculate a value weighted index for Jan. 14th if the initial index value is 100.

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

-Refer to Exhibit 4.2. Calculate a value weighted index for Jan. 14th if the initial index value is 100.

A) 100

B) 102.31

C) 123.07

D) 111.54

E) 121.32

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The general purpose of a market indicator series is to provide an overall indication of aggregate market changes or movements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

-Refer to Exhibit 4.2. What is the divisor at the beginning of January 16th?

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

-Refer to Exhibit 4.2. What is the divisor at the beginning of January 16th?

A) 1.9375

B) 3.0

C) 2.5

D) 2.2734

E) 3.2852

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 89

Related Exams