A) $36,668

B) $37,740

C) $40,000

D) $17,800

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What amount will be in a bank account three years from now if $6,000 is invested each year for four years with the first investment to be made today?

A) ($6,000 × 1.260) + ($6,000 × 1.166) + ($6,000 × 1.080) + $6,000

B) $6,000 × 1.360 × 4

C) ($6,000 × 1.080) + ($6,000 × 1.166) + ($6,000 × 1.260) + ($6,000 × 1.360)

D) $6,000 × 1.080 × 4

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ed Sloan wants to withdraw $20,000 (including principal) from an investment fund at the end of each year for five years.How should he compute his required initial investment at the beginning of the first year if the fund earns 10% compounded annually?

A) $20,000 times the future value of a 5-year, 10% ordinary annuity of 1.

B) $20,000 divided by the future value of a 5-year, 10% ordinary annuity of 1.

C) $20,000 times the present value of a 5-year, 10% ordinary annuity of 1.

D) $20,000 divided by the present value of a 5-year, 10% ordinary annuity of 1.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ann Ruth wants to invest a certain sum of money at the end of each year for five years.The investment will earn 6% compounded annually.At the end of five years, she will need a total of $40,000 accumulated.How should she compute her required annual invest-ment?

A) $40,000 times the future value of a 5-year, 6% ordinary annuity of 1.

B) $40,000 divided by the future value of a 5-year, 6% ordinary annuity of 1.

C) $40,000 times the present value of a 5-year, 6% ordinary annuity of 1.

D) $40,000 divided by the present value of a 5-year, 6% ordinary annuity of 1.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For which of the following transactions would the use of the present value of an ordinary annuity concept be appropriate in calculating the present value of the asset obtained or the liability owed at the date of incurrence?

A) A capital lease is entered into with the initial lease payment due one month subsequent to the signing of the lease agreement.

B) A capital lease is entered into with the initial lease payment due upon the signing of the lease agreement.

C) A ten-year 8% bond is issued on January 2 with interest payable semiannually on January 2 and July 1 yielding 7%.

D) A ten-year 8% bond is issued on January 2 with interest payable semiannually on January 2 and July 1 yielding 9%.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What amount should be deposited in a bank today to grow to $3,000 three years from today?

A) $3,000 ÷ 0.751

B) $3,000 × 0.909 × 3

C) ($3,000 × 0.909) + ($3,000 × 0.826) + ($3,000 × 0.751)

D) $3,000 × 0.751

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Compound interest uses the accumulated balance at each year end to compute interest in the succeeding year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Compound interest, rather than simple interest, must be used to properly evaluate long- term investment proposals.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

If $3,000 is put in a savings account today, what amount will be available three years from today?

A) $3,000 ÷ 1.260

B) $3,000 × 1.260

C) $3,000 × 1.080 × 3

D) ($3,000 × 1.080) + ($3,000 × 1.166) + ($3,000 × 1.260)

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Present value is

A) the value now of a future amount.

B) the amount that must be invested now to produce a known future value.

C) always smaller than the future value.

D) all of these.

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

True/False

In determining present value, a company moves backward in time using a process of accumulation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2007, Nott Co.sold to Day Corp.$400,000 of its 10% bonds for $354,118 to yield 12%.Interest is payable semiannually on January 1 and July 1.What amount should Nott report as interest expense for the six months ended June 30, 2007?

A) $17,706

B) $20,000

C) $21,247

D) $24,000

F) B) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

The market price of a $200,000, ten-year, 12% (pays interest semiannually) bond issue sold to yield an effective rate of 10% is

A) $224,578.

B) $224,925.

C) $226,654.

D) $374,472.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which table would you use to determine how much you would need to have deposited three years ago at 10% compounded annually in order to have $1,000 today?

A) Future value of 1 or present value of 1

B) Future value of an annuity due of 1

C) Future value of an ordinary annuity of 1

D) Present value of an ordinary annuity of 1

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Schmitt Corporation will invest $10,000 every December 31st for the next six years (2006 - 2011) .If Schmitt will earn 12% on the investment, what amount will be in the investment fund on December 31, 2011?

A) $41,114.

B) $46,048.

C) $81,152.

D) $90,890.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

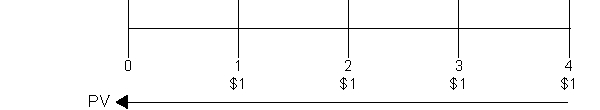

In the time diagram below, which concept is being depicted?

A) Present value of an ordinary annuity

B) Present value of an annuity due

C) Future value of an ordinary annuity

D) Future value of an annuity due

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 1, 2007, Michael Hess Company sold some machinery to Shawn Keling Company.The two companies entered into an installment sales contract at a predetermined interest rate.The contract required four equal annual payments with the first payment due on December 1, 2007, the date of the sale.What present value concept is appropriate for this situation?

A) Future amount of an annuity of 1 for four periods

B) Future amount of 1 for four periods

C) Present value of an ordinary annuity of 1 for four periods

D) Present value of an annuity due of 1 for four periods.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the number of periods is known, the interest rate is determined by

A) dividing the future value by the present value and looking for the quotient in the future value of 1 table.

B) dividing the future value by the present value and looking for the quotient in the present value of 1 table.

C) dividing the present value by the future value and looking for the quotient in the future value of 1 table.

D) multiplying the present value by the future value and looking for the product in the present value of 1 table.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Catt Co.has a machine that cost $200,000.It is to be leased for 20 years with rent received at the beginning of each year.Catt wants a return of 10%.Calculate the amount of the annual rent.

A) $21,356

B) $23,909

C) $29,728

D) $23,492

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Linton Corporation will invest $10,000 every January 1st for the next six years (2006 - 2011) .If Linton will earn 12% on the investment, what amount will be in the investment fund on December 31, 2011?

A) $41,114

B) $46,048.

C) $81,152.

D) $90,890.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 90

Related Exams