A) General Ledger

B) T-account

C) Payroll register

D) General Journal

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm accrues the payroll due but not paid at the end of a financial period, what should it do on the first day of the next financial period?

A) It should create a reversing entry in the General Journal.

B) It should disburse the accrued pay to the employees.

C) It should create a reminder about the accrual to ensure accuracy of computations on the next pay date.

D) It should make a note to create the reversing entry at the end of the next financial period.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does the payroll register connect with the employees' earnings records?

A) Both documents contain information about the employee's address and job title.

B) Both documents contain details of employee earnings, deductions, and disbursement for a pay period.

C) Both documents contain year-to-date totals of taxes.

D) Both documents contain information from multiple pay periods.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The payroll register is identical for each company.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of the June 11 pay date, the General Ledger account for Burling Mills has a balance of $14,289 in its Federal withholding tax payable account. A credit of $16,250 is recorded on the June 25 pay date. What is the balance in the account?

A) Debit $1,961

B) Debit $30,539

C) Credit $1,961

D) Credit $30,539

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What are the General Journal entries that should appear on each pay date?

A) Employee pay accrual and employee pay disbursement

B) Employee pay remittance and voluntary deduction remittance

C) Employee pay recording and employer share payroll taxes recording

D) Employee pay disbursement and voluntary deduction remittance

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

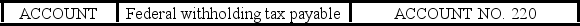

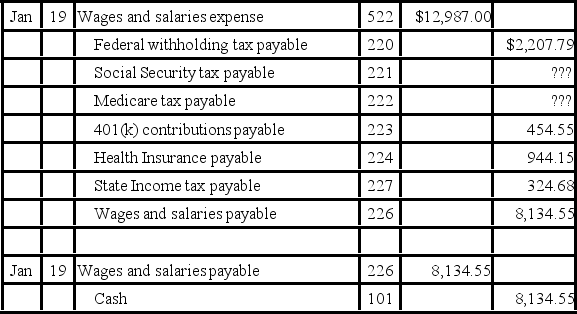

Enchanted Creations has the following data in its Federal withholding tax payable General Ledger account:

What is the balance of the account as of April 30?

What is the balance of the account as of April 30?

A) Credit $16,495

B) Debit $16,495

C) Debit $49,485

D) Credit $49,485

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

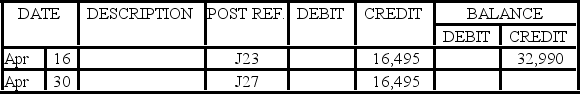

The following data is for the January 19 pay date for Waryzbok Inc.:  Which of the following represents the missing Social Security and Medicare taxes?

Which of the following represents the missing Social Security and Medicare taxes?

A) Social Security tax, $746.66; Medicare tax, $174.62

B) Social Security tax, $188.31; Medicare tax, $805.19

C) Social Security tax, $204.15: Medicare tax, $792.35

D) Social Security tax, $792.35; Medicare tax, $204.15

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why is it important to have columns on the payroll register title "Earnings subject to Federal Withholding" and "Earnings subject to FICA"?

A) It adds complexity to the payroll register.

B) Both columns contain information about the employer's tax matching responsibilities.

C) It facilitates accuracy in employee payroll tax computations.

D) It allows payroll employees to divert funds into faux accounts.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What does the term "billable time" mean as it pertains to payroll accounting?

A) It is employee labor that may be billed to customers.

B) It is employee labor that does not pertain to labor on customer jobs.

C) It is non-employee labor that the company must pay.

D) It is non-traceable labor that a company must absorb as overhead.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A debit always decreases the balance of an account.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Two complete payroll-related General Journal entries are recorded each pay period: one for the employees' payroll, one for the employer's share of the taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 72 of 72

Related Exams